Ukraine invasion won’t dent China’s push to surpass US, become top economy by 2030 – Beijing adviser Justin Lin Yifu

The ongoing war in Ukraine will not halt China’s push to surpass the United States to become the world’s largest economy by 2030, according to a senior Beijing adviser, despite a recent sell off of Chinese bonds by overseas investors.

Russia’s invasion comes at a time of downward economic pressure and rising tensions with Western powers for China, as well as global uncertainty caused by the war in Ukraine and the ongoing disruptions caused by the coronavirus.

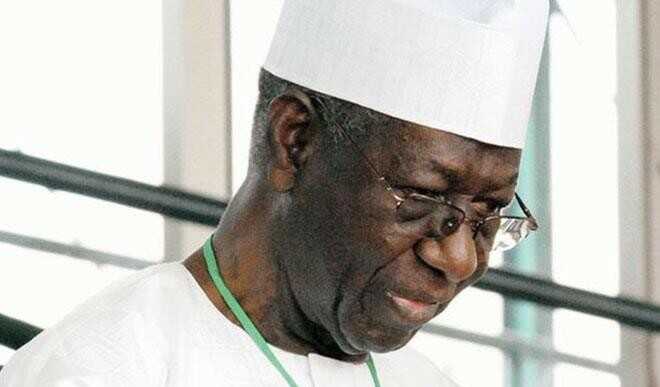

“I’m pretty confident in my estimate that China will surpass the US by 2030,” said Justin Lin Yifu, a former World Bank vice-president who is now a professor at Peking University.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Washington and its allies have strengthened sanctions on Russia, including the exclusion of Russian banks from the Swift financial messaging system, while they are also considering cutting off Russian energy imports.

Brent crude oil prices rose to a 13-year high of US$139 per barrel on Monday, and with it, created huge uncertainties for the global economy.

‘No desire to pay’: China’s manufacturers feel the pain of Ukraine crisis

Lin, a former Taiwanese military officer who defected to the mainland in 1979, also believes China’s inflation will not rise quickly despite the increasing cost of oil and food.

On Saturday, Premier Li Keqiang set a target for China’s consumer price index (CPI) growth for the year at “around 3 per cent” while delivering the government work report for 2022. China is set to announce February’s CPI figure on Wednesday, with expectations that it will remain unchanged at 0.9 per cent growth compared to the same period last year.

“We hope the war ends soon. If so, the impact [on the Chinese economy] will be limited,” added Lin, who was speaking during the ongoing “two sessions” in Beijing on Monday.

A sign of uncertainty has, though, crept into China’s bond market as overseas investors made the rare move of slashing their holding by 67 billion yuan (US$10.6 billion) last month to 3.67 trillion yuan (US$580 billion), despite the yuan exchange rate against US dollar approaching nearly a four-year high.

It remains unclear who has cut their holdings as no breakdown figures were provided, but ANZ Bank estimated earlier that Russia’s central bank and sovereign fund, which have both been sanctioned, may hold US$140 billion worth of Chinese bonds.

Lin, who holds a doctorate in economics from the University of Chicago, is well-known for his strong belief that China has the potential of maintaining an average annual growth rate of 8 per cent until 2035.

He also is a long-term advocate of the state taking an active role in industrial planning to help developing countries quickly catch up with advanced economies.

Beijing set a gross domestic product growth target of “around 5.5 per cent” this year, compared to actual growth of 5.1 per cent over the past two years and a 4.8 per cent estimate for 2022 by the International Monetary Fund.

Lin has based his ambitious economic growth estimate on China’s unfulfilled potential, which will guarantee at least 2-3 percentage points of growth more than the US in coming years.

“China has the room to upgrade its traditional industries. As the most populous country, it has comparative advantage and a large domestic market,” he said.

“In the area of the new economy, China also enjoys the advantage of being able to change lanes to overtake.”

The Development Research Centre of the State Council, a governmental think tank, previously estimated that China will overtake the US in around 2032.

China’s economy approached three quarters of the size of the US economy last year, and it is already viewed as a strategic rival with escalated technological containment and economic decoupling attempts by Washington.

What is China’s Swift equivalent and what are its origins?

Lin criticised the US for using the global financial infrastructure – including Swift and the US dollar system – as a sanctions tool, which was a threat China faced in 2019.

“Business and politics should be separated,” he added. “It will bring shocks to the international financial system.”

Beijing has strengthened the construction of its home-grown yuan cross-border payment and settlement system and continued to push for more overseas use of the Chinese currency.

Lin said that the internationalisation of the yuan should be in line with China’s rising economic power, but any overtaking in terms of size of economy will not guarantee the yuan will also replace the US dollar.

“It should be a rather long process,” he added.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2022 South China Morning Post Publishers Ltd. All rights reserved.

Source: SCMP