*Attributes Nigeria’s inability to sell its full OPEC quota to “chronic oil theft”

It said the Tinubu administration’s economic reforms need to regain momentum as there are signs of things going awry.

By KEMI KASUMU

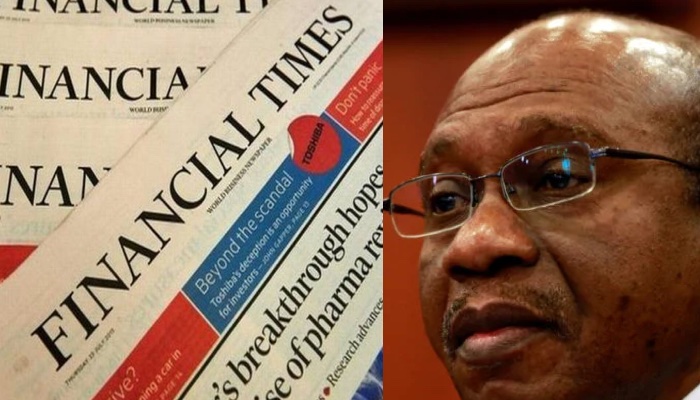

The Financial Times (FT) of London has stated that the manner in which the former Governor of Central Bank of Nigeria (CBN), Mr. Godwin Emefiele, was removed from office was odd and smacked of political revenge.

Emefiele was initially arrested over allegations of illegal possession of firearms.

It made this known in its editorial headlined “Nigeria’s economic reforms need to regain momentum” and published on Tuesday October 3, 2023.

The Financial Times, which stated in its first line that “Bola Tinubu, Nigeria’s new president, started off with a bang,” noted that on assumption of office the Nigerian President had moved quickly to raise expectations.

But the FT pointed out that four months into his administration, Nigerian economic reforms needed to regain momentum as there are signs of things going awry.

The report, which described the changes at the central bank as half-cooked, however said Emefiele’s removal was overdue.

In his inauguration speech in May, the report said Tinubu scrapped petrol subsidy that had cost the Nigerian government $10 billion in 2022. It stated that the previous administrations had tried, and failed, to remove petrol subsidy.

The report, which hailed Tinubu’s decision, added that because Nigeria imported most of its refined petroleum products, the subsidy had become a licence for middlemen and crooks to profit from arbitrage. It said with the removal, the Nigerian government is $10billion better off.

FT, however, insisted that the government needs to explain how it is going to use the money to improve people’s lives.

“It could make direct payments to the most vulnerable or set out plans to bolster public services such as health and education. So far, it has been silent,” the report said. The report argued that Tinubu has not done enough to explain the “rationale of a policy that, to many Nigerians, seems like the withdrawal of the only thing the state had ever done for them.”

“As petrol prices rise, millions of people – already under pressure from rising food prices – are having to walk miles to work. Changes at the central bank are similarly half-cooked. The removal of Godwin Emefiele, the previous governor, was overdue. But its manner, initially via a charge of firearms’ possession, was odd and smacked of political revenge.

More substantively, the new exchange rate regime has yet to be properly explained,” the report added.

It argued that after a signal was given in June that banks could bid freely for foreign currency, the naira fell nearly 30 per cent, pushing inflation up still further to an 18-year high of nearly 26 per cent.

“Still, the move to a more realistic exchange rate was a vital step in persuading investors that they could obtain dollars, either to invest in manufacturing inputs or to repatriate as profits. But dollar liquidity has since tightened as investors seek to clear a backlog of $7billion in previously unsatisfied demand.”

According to the FT, after a convergence of the official and black-market rate, a gulf has reopened: Parallel rate has fallen to N1,000 versus an official rate of N785. Opacity about the true level of net foreign reserves — by one estimate as low as $4 billion — has exacerbated the problem.

It attributed Nigeria’s inability to sell its full OPEC quota to “chronic oil theft”. Curbing the looting of Nigeria’s patrimony, the report said is one of Tinubu’s most urgent tasks.

The report added that the Senate’s recent confirmation of Olayemi Cardoso as the new CBN governor may steady the ship at that institution.

“Markets consider Cardoso, a former Citibank Nigeria chair, to be a sound appointment. (The same cannot be said of all of Tinubu’s picks.) The incoming governor will probably need to raise rates at the next policy meeting to establish his inflation-busting credentials. It is vital that Tinubu restores institutional independence by leaving the bank to get on with its job. In other areas the president needs to be more active – and more articulate.

The report advised that Tinubu to spell out his policies to the public, adding that he should also refrain from announcing plans – including the restoration of democracy in Niger – without any real idea of how to implement them.

“Only four months into his presidency, what started out with a bang risks becoming a whimper. Tinubu needs to regain the momentum,” the report added.