Jaiz Bank to relax KYC requirements to boost financial inclusion

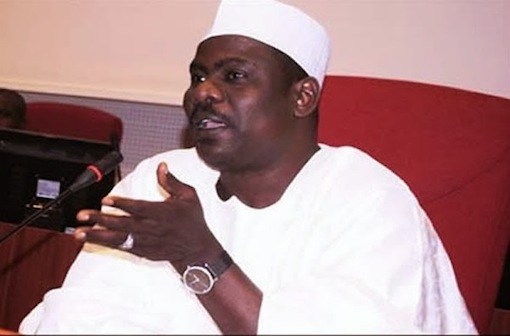

The Managing Director/Chief Executive, Jaiz Bank Plc, Mr. Hassan Usman, has reiterated the bank’s commitment to facilitating financial inclusion to a large segment of the society who are currently excluded from its financial services.

To this end, he noted that the targeted group or those who don’t have access to financial services would be allowed to open account without meeting the strict Know Your Customer (KYC) requirements including utility bills, international passports among others.

According to him: “These people don’t have that but the policy allows us to open accounts for people at that level.

These accounts are opened as financial inclusion accounts and then graduate into the next level but what we are trying to do is to use channels such as agency banking, our own branches and other digital avenues to allow as many people to come on board and also empower them with little credit.”

He said once the pilot programme succeeds in Katsina, it would then be rolled it out across many other locations.

“We are aggressive in this area of financial inclusion. Our experience with the pilot so far is exiting because people like to be supported. The only challenge is in convincing beneficiaries that the money is not free, that it will have to be repaid. Everyone would like to be supported financially,” he said.

Speaking at the National Financial Literacy Stakeholders’ Conference in Abuja recently, he said the bank- being itself a child of financial inclusion policy of the federal government to provide non-interest banking for those who prefer it- would ensure that there is deep penetration of financial services to ordinary citizens.

He said the financial institution had been part of the process of ensuring financial inclusion through agency banking and use of technology to reach the unbanked.

He said: “We are running a pilot in a village in Katsina State where we will interact with women entrepreneurs that are selling akara (bean cake), fura de nunu and such other micro businesses so that we can empower them.

“We are not going there primarily to get deposit but to empower them with small credits so that they will now in turn generate wealth. What we are trying to do at this stage is to empower these women groups both in the villages and the cities so that they can get some financing that they presently lack to develop their business.”