• Customs: We are merely obeying CBN’s directive

• 50kg bag of rice may cost N100,000, says CPPE

• Customs under pressure to meet N5 trillion target, say stakeholders

The adoption of the spot foreign exchange (FX) rate in computing duty on imported commodities has thrown importers and the entire business community into a panic mode.

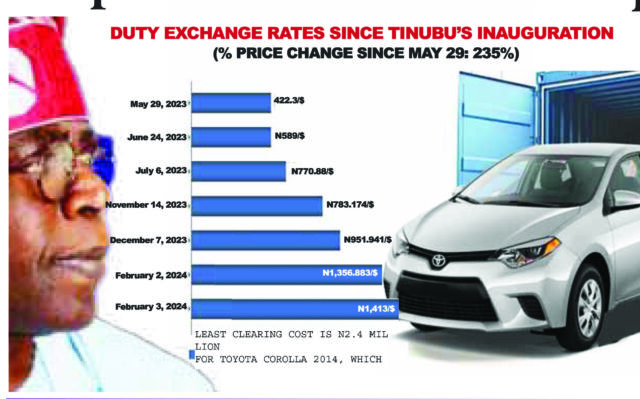

For the first time, the Nigeria Customs Service (NCS) raised the import duty exchange twice within 24 hours on Friday under the guise of “obeying” the Central Bank of Nigeria’s (CBN) directive. The unusual adjustment raised the going duties across commodity lines by 48.5 per cent in less than two days.

Recall that NCS adjusted the rate from N951.94/$ to N1356.8/$ on Friday. While the market was yet to fully digest the decision, it was raised further by over four per cent on Saturday, to the current N1,413.6 to a dollar.

In a swift response, the NCS said the service is simply adhering to the official market as directed by the Central Bank of Nigeria (CBN).

Since President Bola Ahmed Tinubu came into office, the import duty determination rate has been increased by 235 per cent. It stood at N422.3/$ as of May 29, 2023, when the administration was inaugurated.

With the liberalisation of the FX market, naira saw a sharp depreciation last June, forcing NCS to also adjust the rate used for duty assessment. Since then, the Customs rate mimics the spot segment of the FX market, explaining it is not a decision it has control over.

The service has ignored calls for the adoption of the average rate as opposed to the spot rate. Those who have advocated average rate adoption have argued that the option would make more sense for the predictability and stability of prices.

With spot rate adoption, the Customs has left importers guessing what the next day’s duty could be – a situation economists said could worsen the inflation, increase the cost of living and raise the poverty index.

The fresh increase has already triggered a negative response in the prices of goods, including staple food. At the weekend, The Guardian learnt, the prices of many imported items were hurriedly adjusted. A list of cosmetics items sighted by our correspondent added about 18 to 25 per cent across the prices.

Some products that sold for N2,200 per unit were adjusted to N2,600, while the dealer explained that he would pay more to clear his goods, hence he had to make provision for the upward movement of the replacement cost.

There are fears that the prices of rice, a staple food consumed by many Nigerian households, could see a further sharp rise in the coming days following the increase.

As at last May, a bag of 50 kilogramme of rice sold for about N38 but soared by close to 100 per cent to N70,000 at the close of the year, following the hike in prices of fuel and importation. Traders said Nigeria should expect the essential item to hit N100,000 sooner than expected as the rising cost of import feeds into general prices.

An average Nigerian faces tough times in the face of the rising cost of importation. Last year, as in the case of previous ones, the five top imports by value were motor spirit, gas oil, wheat, sugar and used vehicles. Whereas naira depreciation means the subsidy cover for the motor spirit would expand drastically, Nigerians would face the direct consequence of spending more on wheat, sugar and used vehicle purchases.

Already, prices of vehicles have hit the roof with the cheapest cars (1990s sedans) selling for between N3.5 million and N4.5 million even before last week’s duty review. The least cost of clearing, as at the weekend, according to information sourced from clearing agents, was N2.4 million. A car dealer told The Guardian yesterday that he had increased asking prices of the vehicles at his shop on Saturday following the announcement of the new duty.

Last year, the value of used vehicles, which accounted for 1.64 per cent of the total import, was N135.82 billion. As duties went up last year, the number of cleared vehicles dipped by 32 per cent to 132,296 units, leaving thousands of units at the ports accumulating demurrages. This suggests that the government would need to find a way to manage rising abandoned vehicles this year even as duty cost doubles or triples.

The Chief Executive Officer of the Centre for The Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, said the drastic upward review of the exchange rate for the computation of import duties would further fuel inflation as production and operating costs escalated.

He said this would have a devastating effect on businesses across sectors, while the vulnerable segments of the population would be impoverished as cost-push inflation gets exacerbated.

Yusuf said businesses are yet to recover from the shocks of the new round of currency devaluation resulting from the sudden unification of the exchange rate, which has driven the official exchange rate to over N1,400/$.

He appealed to the government to reverse this rate hike in the interest of the already-impoverished segments of society and the numerous businesses that are on the verge of collapse.

Yusuf recommended that going forward, the determination of the exchange rate for import duty computation should be treated as a major fiscal policy matter and located within the remit of the fiscal authority which is the finance ministry.

Professor Sheriffdeen Tella, an economist, said that raising custom duties on luxury and finished products is key for higher economic growth and job creation to reduce current unemployment for the people. However, he argued that while Customs needs to raise its revenue base, such an action must not be at the expense of Nigerians.

Director, Obsidian Archenar Nigeria, Kelvin Emmanuel, said the NCS is simply complying with the policy direction of the CBN.

His argument: “Before now, Nigeria was operating a peg system, which is a term for the fixed exchange rate. That is why the rates were able to stay stable for a long period. Now, with naira floated, the NCS can no longer maintain fixed figures.”

While he agreed that frequent changes in the import duties would destabilise the business community and make planning almost impossible, he submitted that the federal government can generate massive revenue from the new system.

“As desirable as having stability in the import duties sounds, I do not think that will be done immediately. The Federal Government will generate huge revenue, but the cost of importation will rise. Manufacturers will face more hard times. Consumers will face more hard times,” he stressed.

On whether the reduction in import rates for essential commodities and inputs for the manufacturing sector would help, Emmanuel said he does not see that happening any time soon.

“I do not think reducing import duties on these categories of items will lead to a significant reduction in the prices of feedstock and staple food. Once the currency that will be used for the imports is in foreign currency, their prices may not drop significantly,” he said.

Emmanuel argued that the CBN is in a quagmire if it cannot source about $10 billion that is needed to stabilise the FX market.

The factors may likely lead to the prices of rice skyrocketing to more than N100,000 per bag, the National Public Relations Officer of the Association of Registered Freight Forwarders of Nigeria (AREFFN), Taiwo Fatomilola, said.

He said the costs of transport would spike as car purchases and spare parts would increase. He lamented that the rise in duty exchange rate will kill importation, as importers cannot cope.

He said the country, last year, witnessed a drop in importation, adding that this increase will also have a multiplying effect on every product sold in Nigeria.

Fatomilola said vehicle duties have increased drastically with a single six-tyre 2014 model truck head going for N2.6 million as at Saturday morning. According to him, the hike in the duty exchange rate is caused by the desperation of Customs to meet its N5 trillion target for the year.

Recall that the country witnessed a 32 per cent decrease in the importation of vehicles in 2023. A total of 132,296 units of vehicles were handled during the period, a sharp fall from 194,550 units cleared in 2022.

In his response, the National Public Relations Officer, Nigeria Customs Service, Abdullahi Maiwada, stressed that Customs does not determine the exchange rate, but only implements what is derived by the government.

Naira vs Dollar.

This is the fifth adjustment after the Central Bank started the implementation of a market-led FX rate regime last year. That puts the average review at once a month.

The duty FX rate was adjusted from N422.3/$1 to N589/$1 On June 24 while on July 6, 2023, it was adjusted to N770.88/$1. It went to N783.174/$1 on November 14, 2023. On December 7, 2023, it was adjusted to N951.941/$1.

Source: Guardian