As President Muhammadu Buhari commissions the modern office of the African Development Bank (AfDB) in Nigeria on January 18, 2018, it is pertinent to refresh our memories of the relationship between Nigeria and the Bank, examine its role in our national development and explain why it is necessary for Nigeria and other stakeholders in the Bank to ensure that it is sustained as a key development partner.

Background

The African Development Bank came into being on August 14, 1963 after signing an agreement by its founding member states in Khartoum, Sudan. The agreement became effective on September 10, 1964. The regional multilateral development finance institution comprises three arms or entities, namely: the African Development Bank (ADB), the African Development Fund (ADF) and a specialized vehicle, the Nigeria Trust Fund.

The bank has member countries from Africa (54 of them) and 26 non-African members from Europe, America and Asia. The non-regional member countries joined in order to boost the lean financial resources available for its lending and funding of development projects by governments and investments by the private sector, respectively.

Mission

The key mission of the AfDB, according to an entry on its website “is to promote the investment of public and private capital in projects and programmes that are likely to contribute to the economic development of its stakeholders. The bank therefore finances projects run either by the government or the private sector.”

The Bank further explains its missions thus: “As the premier development finance institution on the continent, the AfDB’s mission is to help reduce poverty, improve living conditions for Africans and mobilize resources for the continent’s economic and social development.”

It is within its mission statement that the bank puts emphasis on assisting individual African countries or collectively, in their efforts to achieve economic development and social progress.

Main areas of focus

The AfDB finances multi-faceted projects in the fields of Agriculture, Health, Education, Public utilities, Transportation, Telecommunications and Investments in the private sector.

The AfDB Group says that it has widened the scope of its activities. It now covers “new initiatives such as the New Partnership for Africa’s Development (NEPAD), water and sanitation and HIV/AIDS. It is also involved in initiatives on debt reduction.”

AfDB and Nigeria

Beside the important role played by Nigeria in establishing the Bank, the country has continuously sustained a strong, positive and active role in ensuring that the Bank thrives and succeeds in achieving its missions and lofty goals. One very important contribution made by Nigeria in supporting the activities of the Bank is the creation of the Nigeria Trust Fund in 1976 to enable the Bank “help the institution’s most underprivileged member countries and provide 2-4 per cent interest rate loans payable over 25 years.”

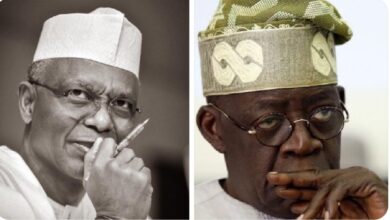

Nigeria equally contributed highly skilled and capable personnel to key positions and senior posts in the Bank’s management hierarchy. This can be illustrated most vividly by the fact that Dr. Akinwunmi Adesina, OFR, the current President of the AfDB Group, is a Nigerian. He is Nigeria’s immediate former Minister of Agriculture and Rural Development.

I watched Dr. Akinwunmi Adesina and reported him very closely during his tenure as Minister of Agriculture. I can recall that he promoted the idea of seeing agriculture as a business, made Nigerian farmers conscious of the difference between seeds and grains, expanded the production of stable crops, advocated the development of value chains of 13 commodities and ensured peasant farmer’s access to agricultural inputs through the e-Wallet. The Agricultural Transformation Agenda (ATA) he championed is still valid, and some of the legacies of the Agenda include the boost in the export of various agricultural products and greater use of locally-sourced agro-raw materials by processors.

One other very important fact in the relationship between Nigeria and the AfDB is that, Nigeria has the largest single shareholding in the Bank, standing at around 9.331 percent. Nigeria also accounts 6.6 percent of the Bank total portfolio, with 73 projects and programmes across public and private sectors of economy. The Bank, according to a statement it issued recently, started operations in the country in 1971. Since then, it has been a win-win situation for the Bank and Nigeria.

The statement said more on the relationship: “The Bank has positioned itself as the preferred lending partner in Nigeria as it continues to support Nigeria’s long-term aspiration to be among the top 20 economies in the world by the year 2020.”

The Abuja Nigeria Country Department office complex is reportedly the first permanent structure to be designed and constructed outsideits headquarters in Abidjan, Cote D’Voir. The beauty in it all in addition to its dazzling appearance is that it comes with 220 jobs.

The Rest of Africa

As for the rest of Africa, the Bank has funded hundreds of completed or on-going projects in various countries on the African continent, thereby making the desired positive impact on the lives of millions of Africans. For this reason, all countries on the continent should endeavour and ensure that the Bank thrives and grows. This they can do basically by paying any outstanding subscriptions to the Bank fully and promptly.

*Salisu Na’inna Dambatta is Director of Information in the Federal Ministry of Finance, Abuja.