NNPCL gets Tinubu’s nod to pay subsidy using 2023 dividends – Report

By OUR REPORTERS

The NNPCL explained that the removal of the petrol subsidy in June 2023 initially led to monthly savings of N400 billion for the federation, enabling the company to remit N2.032 trillion in taxes and royalties by January 2024. However, the devaluation of the naira led to a significant increase in the NAFEX exchange rate, which, in turn, caused the subsidy bill to escalate.

It has been reported that President of Nigeria Bola Ahmed Tinubu, has approved the request of privatized Nigerian National Petroleum Corporation Limited (NNPCL) to use the 2023 final dividends – due to the Federation – to cover petrol subsidy payments.

This, it was gathered, is according to a media report, which further reported that the President also sanctioned the suspension of 2024 interim dividends to support NNPC’s cash flow, as the national oil company struggles with the financial burden of the petrol subsidy.

The NNPC informed the president that it would be unable to remit taxes and royalties to the federation account due to these subsidy payments, which it termed “subsidy shortfall/FX differential.”

But inquisitive public, familiar with what they call propaganda of how the administration tests the ground to sell an information, are asking how the NNPCLhas been able to get subsidy on sales of crude when the Tinubu government is said to be operating a country, which crude has since been swapped for the $1.5 billion President Muhammad Buhari took from the World Bank before leaving office.

The DEFENDER, in its recent reports, has consistently shown how the $1.5 billion Buhari took was not only a non-crude swap but used for the fixing of the Port Harcourt Refinery beginning at the tail end of his administration and which completion the Tinubu administration had acknowledged since August 2023 although his supporters claimed it to be a magic that he was able to perform in three months as “he fixed Port Refinery for real”.

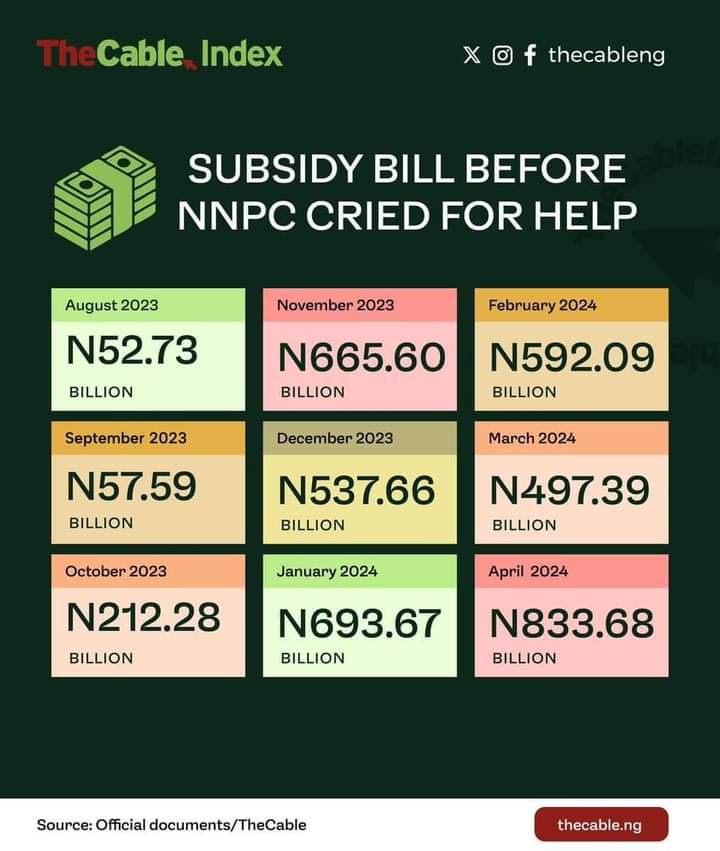

According to another media source, NNPCL’s financial forecast reveals that the cumulative petrol subsidy bill from August 2023 to December 2024 will reach N6.884 trillion, leaving the company unable to remit N3.987 trillion in taxes and royalties to the federation. The company had previously warned President Tinubu in June 2024 that the subsidy payments were severely impacting its cash flow, making it difficult to sustain petrol imports due to “forex pressure.”

The NNPCL explained that the removal of the petrol subsidy in June 2023 initially led to monthly savings of N400 billion for the federation, enabling the company to remit N2.032 trillion in taxes and royalties by January 2024. However, the devaluation of the naira led to a significant increase in the NAFEX exchange rate, which, in turn, caused the subsidy bill to escalate.

The NNPC’s costs for fuel importation turned negative in August 2023 and continued to rise, reaching N833.68 billion by April 2024. This financial strain forced NNPC to seek President Tinubu’s approval to use the 2023 dividends to cover the subsidy costs.

Despite previous denials by the presidency that the subsidy would be reinstated, the NNPC’s internal communications with the president now openly refer to the ongoing financial support as a “subsidy.”

The administration’s official stance remains that “subsidy is gone,” even as NNPC projects that subsidy costs will exceed N5 trillion in 2024. The company uses a “derived FX rate” to keep petrol prices within the N600-N700 per litre range, with the gap between this rate and the official exchange rate constituting the subsidy/FX differential, according to a Premium Times report.