$2b Bank Fraud: FG probes 2 serving ministers, ex-CBN gov

…65,000 lose shares to phoney offshore entities

…Probe follows last month’s petition to AGF by aggrieved shareholders

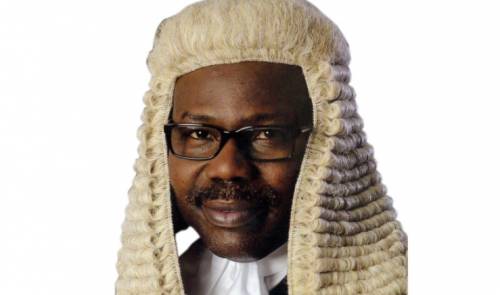

The Federal Government has launched a probe into how a former Central Bank Governor connived with two serving ministers in the present administration to rip off no fewer than 65,000 Nigerians through official manipulation and transfer of their shares to foreign entities for pecuniary reasons.

The probe was triggered by a strong petition filed by shareholders, whose shares were inexplicably reduced by the key government agencies and officials and awarded to the foreign entities apparently fronting for them.

Before now, allegations against serving ministers and top government officials were hardly investigated by the anti-graft agencies. This tended to give credence to allegations that President Buhari’s anti-graft war was targeted at only the opposition. The latest development, our sources said, could prove critics wrong.

The government swung into action immediately after the petition was received and acknowledged by the Public Prosecution Department of the OHAGF on April 3, 2019, according to documents sighted by Saturday Vanguard.

In the petition entitled: “Official Corruption, Misuse of FGN $2 Billion, Fraud And Unjust Enrichment Of Persons Who Dispossessed More Than 65,000 Nigerians And Conferred Ownership Of A Nigerian Bank On Few Nigerians And Their Foreign Accomplices,” the victims detailed how the illicit bank deal was structured and executed by the culprits now working with the government as ministers of the Federal Republic of Nigeria.

It was learnt that on getting the petition, the government immediately set in motion a strong team to study it and take urgent steps to investigate the claims in the documents and refer the matter to appropriate anti-graft agency to deal with any economic and financial crimes that might have been orchestrated by the suspects.

A source close to the investigation said that the government was concerned about the role played by the two ministers and the former CBN governor.

Findings show that while one of the ministers, headed a federal regulatory agency at the time, his colleague was a key financial market player at the time and masterminded the deals leading to the loss of hundreds of millions of Naira by Nigerians to foreigners. In particular, the government wants the investigators to probe whether there were insider deals that led to the dispossession of Nigerian shareholders and investors and transferred their interest to foreign elements and why the CBN approved such a dubious deal in the first place despite clear evidence that it did not pass a CBN ‘fit and proper test’. The document sighted by Saturday Vanguard shows that one of the serving ministers masterminded the transaction by floating a Nigerian firms that brought a Mauritius shell company to house Nigerians pretending to be foreign investors in order to swindle them.

The minister is also said to have organized the registration of the offshore shell company in Mauritius principally for the purpose of disguising the true majority ownership of the Bank’s shares concealed in the offshore company.

On the other hand, the other minister is reported to have approved the defective bank transactions when it was brought to his agency instead of rejecting it based on certain deficiencies. The document indicated that he was ‘rewarded’ with a strategic appointment by the bank shortly after that defective deal approval.

As a result of that development, 49% of that bank’s shares is now owned and controlled by a London-based firm, whose chief executive had since been sacked for involvement in other manipulative bank deals. The illicit transaction, it was gathered effectively diluted more 65,000 Nigeria former shareholders of the commercial bank by 85% to less than 15% of public float, making it impossible for the bank to be listed on the Nigerian Stock Exchange, NSE.

But despite being owned by a few private equity firms and struggling to survive till date, the commercial bank has used powerful connections to remain on the NSE.

Saturday Vanguard learnt that federal investigators are to unravel if the said bank has also concealed from regulators, investors and the public outstanding Swiss Court judgment debts of more than N1 billion and imminent judgment debts of N5 billion respectively.

One of the aggrieved shareholders, who pleaded anonymity, lamented that the bank had not paid cash dividends in nearly ten years while the financial statements show princely remunerations to executive management, directors and lawyers paid to defer more than $50 million of claims against the bank.

The informed source said: “It is a thing of joy that the government has finally decided to look into this monumental fraud with a view to bringing the masterminds to book. It is also interesting that many discontented former shareholders of the bank who were dispossessed of 85% of the value of their shares are happy that equally aggrieved persons and companies have come forward to provide information that in their opinion should lead to reversal of the odious transactions and return of the bank to former Nigerians shareholders.

The source, in commending the government’s determination to fight corruption also advised that the criminal investigations should be pursued arduously so that dispossessed shareholders, investors and those that are owed by the bank can get justice promptly. Saturday Vanguard