CommentsGeneral News

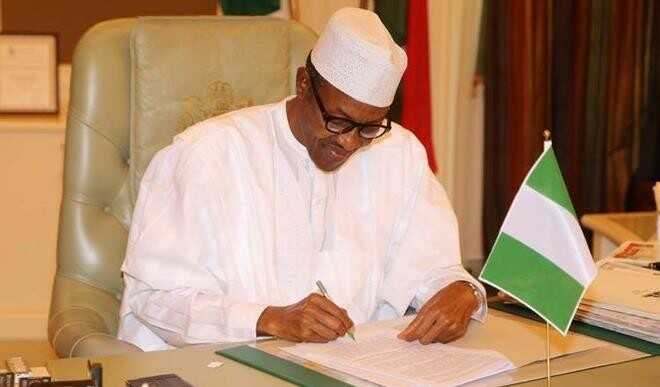

11 things that show the FG is committed to improving Fiscal Transparency and Accountability

- The Presidential Initiative on Continuous Audit (PICA):

PICA was set up by President Muhammadu Buhari to strengthen controls over FG finances through a continuous internal audit process across all Ministries, Departments and Agencies (MDAs), particularly in respect of payroll. Through the activities of PICA, a total of 53,000 erroneous payroll entries have been identified, with payroll savings of N198 billion achieved in 2016. Also, the Federal Ministry of Finance has set a target to ensure that the Federal Government’s Payroll Platform — the ‘Integrated Personnel Payroll Information System’ (IPPIS) — covers 100 percent of MDAs by the end of 2017. Currently 60% of MDAs are enrolled on the IPPIS platform. - Budget Reforms:

First, a Presidential Order was issued directing that all budgets of all Government Agencies be prepared in line with International Public Sector Accounting Standards (IPSAS), using a budget template developed for that purpose. Second, the 2017 Budget was collated using a web-based application developed by the Budget Office of the Federation (BOF), for the first time ever. Instead of the traditional method of hard copy submissions of budget proposals, Ministries, Departments and Agencies were asked to upload their proposals to the new budget preparation portal. By replacing paper submissions with an audit-able and trackable online system, the 2017 budget preparation process was strengthened against manipulation and unauthorised alteration. All MDA budget proposals were uploaded to the new system, for review and final collation by the Budget Office. More than 4,000 staff of the MDAs were specially trained to use the new application, across multiple locations nationwide. Also to support the deployment of the budget portal, the Budget Office set up a Helpdesk, accessible by telephone and email, for authorised users. - Expansion of TSA Coverage:

On August 7, 2015, President Buhari issued a directive to all Ministries, Departments and Agencies (MDAs) to close their accounts with Deposit Money Banks (DMBs) and transfer their balances to the Central Bank of Nigeria on or before 15th September 2015. This decision to fully operationalise the Treasury Single Account (TSA) system—a public accounting system that enables the Government to manage its finances (revenues and payments) using a single/unified account, or series of linked accounts domiciled at the Central Bank of Nigeria — has resulted in the consolidation of more than 20,000 bank accounts previously spread across DMBs in the country, and in savings of an average of N4.7 billion monthly in banking charges associated with indiscriminate Government borrowing from the DMBs. As at February 10, 2017, a total sum of N5.244 Trillion had flowed into the TSA. The TSA allows the managers of the Government’s finances, including but not limited to the Ministry of Finance and the Office of the Accountant-General of the Federation, to have, at any point in time, a comprehensive overview of cash flows across the entire Government. It also ensures increased transparency in public financial management, as well as prevents a scenario in which some MDAs have idle cash while other MDAs are compelled to borrow exorbitantly from DMBs. The TSA system was launched in 2012, but failed to gain traction until President Buhari’s executive order in August 2015. As at December 2016, 766 MDAs were TSA-compliant. The Ministry of Finance continues to fine-tune the system to improve its efficiency, and has also commenced an audit to ensure that all funds due to the TSA are remitted into it. - Deployment of BVN for Payroll and Social Investment Programmes:

Considering that personnel costs are the Federal Government’s largest expenditure line, the Federal Government has given priority to the deployment of the BVN for payroll and pension audits. The use of BVN to verify payroll entries on the Integrated Personnel Payroll Information System (IPPIS) platform has so far led to the detection of 53,000 erroneous payroll entries. The Federal Government has also ensured the deployment of BVN system to serve as the verification basis for payments to beneficiaries and vendors in the N-Power Scheme and the Homegrown School Feeding Programme (HGSFP) - Replacement of old Cash-Based Accounting System with an Accruals-Based System:

Cash accounting makes no reference to the liabilities that the Federal Government may be required to meet in the future nor does it recognise the benefits that will be obtained from assets purchased over a period of time. The cash accounting system fails to capture information on public sector assets and liabilities which may present the illusion of positive financial results in the short term, at the expense of longer-term fiscal stability and sustainability. Accruals-based accounting, on the other hand, presents the true financial position of the Federal Governments assets and liabilities, which would help the Government plan future funding requirements for asset maintenance and replacement, and the repayment of existing and contingent liabilities and, thus, better manage their cash position and financing requirements. It provides comprehensive information on Government’s current and projected cash flows, leading to better cash management. For example, the conversion from cash accounting to accrual accounting led to the discovery of unrecorded debts owed contractors, oil marketers, exporters, electricity distribution companies and others. - Enlistment into Open Government Partnership (OGP):

In May 2016, President Buhari attended and participated in the International Anti-Corruption Summit organised by the UK Government. At that Summit he pledged that Nigeria would join the OGP, an international transparency, accountability and citizen engagement initiative. In July 2016, Nigeria became the 70th country to join the OGP. Following this, Nigeria constituted an OGP National Steering Committee (NSC), which went on to develop a National Action Plan (2017–2019) that aims to deepen and mainstream transparency mechanisms and citizens’ engagement in the management of public resources across all sectors. The National Action Plan was submitted at the OGP Global Summit in Paris, France, in December 2016. - Insistence on Conditionality of Fiscal Support to States:

The Fiscal Sustainability Plan (FSP) is a reform programme that specifies conditions under which States can access the Federal Government’s N510 billion Budget Support Facility (BSF). The FSP was introduced to enhance fiscal prudence and transparency in public expenditure, across the states. 35 States signed up. Independent verification and auditing of participating States is now ongoing — against the FSP conditions & milestones — by eight (8) accounting firms. State Governments that fail to implement the FSP action plans, as stated, will be taken off the Budget Support Facility with immediate effect. The Fiscal Sustainability Plan is part of our reform of Public Financial Management Systems nationwide.

8. Creation of Efficiency Unit (EU) to spearhead the efficient use of government resources, and ensure reduction in Recurrent Expenditure:The Efficiency Unit reviews all Government overhead expenditure, reduces wastage, provides efficiency and ensures quantifiable savings for the country. Also, the Unit identifies best practices in procurement and financial management for adoption. The Efficiency Unit’s efforts have resulted in approximately N15 billion in savings on travel, sitting allowances and souvenirs. There is also potential savings of N7 billion on other expenditure lines where the unit seeks to control spending through Circulars. In addition, there is on-going work on the deployment of a price-checker, as well as the use of debit cards for payments. - Asset Recovery Reforms:The Constitution of a Presidential Committee on Asset Recovery (PCAR), headed by Vice President Yemi Osinbajo, to bring together all law enforcement agencies involved in the recovery of assets; as well as designation of a dedicated Central Bank Account to receive all recovered funds, for coordination and transparency of management and oversight.

- Reform of longstanding Cash Call Arrangement:In 2016 the Federal Government exited the cash call arrangement by which the Nigerian National Petroleum Corporation (NNPC) traditionally funded its share of the crude oil exploration and production Joint Ventures (JVs) with International Oil Companies (IOCs). The Cash Call obligations had consistently put pressure on the Federal Government’s finances, and a failure to fully fund them has resulted in the accumulation of debt arrears of more than six billion dollars, as at December 2015. Starting 2017, a new funding mechanism is being introduced, which will allow the JVs to transform into independent, self-financing entities. The advantages for the Federal Government finances include: (1) freeing-up the Federal Government from the budgetary obligation of coming up with the cash calls (savings made under the new arrangement can be directed to critical Infrastructure projects), and (2) a potential increase in Nigeria’s oil production to about 2.5 million barrels per day, on account of optimal funding. Also as part of the reforms, the debt arrears owed the IOCs have been negotiated downwards to approximately US$5.1 billion — for which a long-term repayment plan has been drawn up.

- New Whistleblowing Policy:The new Whistleblowing Policy introduced by the Federal Ministry of Finance has already yielded about $160m and N8 billion in recoveries of stolen Government funds.

This appears on nta.com on February 20, 2017.