More warnings as Nigerian Senator asks Tinubu to suspend tax law implementation over forgery claims

By KEMI KASUMU

Ndume said proceeding with implementation without resolving the forgery claims would create a legitimacy challenge for the tax laws. “With the controversy surrounding it, the President should constitute a team to verify the veracity of the claim and act accordingly,” he said.

Beyond calls from ethnic nationality and religious group, members of the political class privy to the workings of legislature in Nigeria have continued to warn President Bola Ahmed Tinubu against insistence on implementing the controversial tax law on his hand.

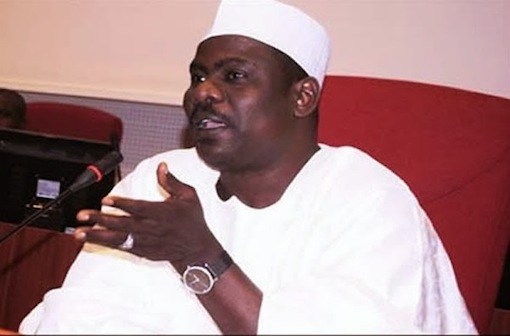

Among the stakeholders is Ali Ndume, senator representing Borno South and former Senate Leader, who urged President Tinubu to halt the implementation of the new tax laws due to take off on January 1, 2026, over forgery claims.

On December 17, Hon Abdussamad Dasuki, a member of the House of Representatives from Sokoto State, claimed that the gazetted tax laws are different from the version passed by the national assembly.

In response, the House of Representatives constituted a seven-member committee to investigate the alleged discrepancies.

In a statement on Wednesday December 24, Ndume urged Tinubu to constitute an ad hoc committee to investigate the veracity of the alleged alterations.

He said proceeding with implementation without resolving the forgery claims would create a legitimacy challenge for the tax laws. “With the controversy surrounding it, the President should constitute a team to verify the veracity of the claim and act accordingly,” he said.

He said, “As a responsive leader that he has always been, he should look at it to find out, if the copy that was signed, whether the claim of alterations was genuine so that he will do the needful to bring the controversy to rest.

“If not, the controversy will continue. That is to say the tax law will not be implemented, because you can’t build on nothing.

“So, Mr. President should suspend the implementation until the issues are resolved because so many civil society organisations, the Arewa community, the Nigerian Bar Association are saying that he should withdraw the Tax Law and investigate the allegation of forgery.

“Therefore, Mr. President should get to the root of the allegation of forgery. The small committee that will be set up should look into it while the House of Representatives does its own.”

On Tuesday December 23, the Nigerian Bar Association (NBA) demanded a suspension of the implementation, saying the controversies surrounding the tax reform acts cast doubts on the integrity and transparency of Nigeria’s lawmaking process.