Time for action against enablers of illicit financial flows in Nigeria, Africa is now, says CISLAC in New York

*As it presents SDG16 shadow report with key recommendations *Lawyers, real estate agents, customs officials, others key actors facilitating laundering of illicit funds - Report "Nigerian govt officials live flamboyant lifestyle amidst hardship suffered by masses - Rafsanjani "Asks govt to stop the trend

By BASHIR ADEFAKA

He called on African leaders to act swiftly and decisively, adding that, “The time for action is now. We must turn the insights from this report into strategies that rid Africa of the shadow networks siphoning off our continent’s wealth, and secure a brighter, more equitable future for all Africans.”

As Lawyers, real estate agents, customs officials and corporate service providers are fingered as key actors facilitating the laundering of illicit funds (IFFs) in Africa, the Civil Society Legislative Advocacy Centre (CISLAC) has issued a strong call for immediate action to tackle the pervasive issue both in Nigeria and across sub-Saharan Africa.

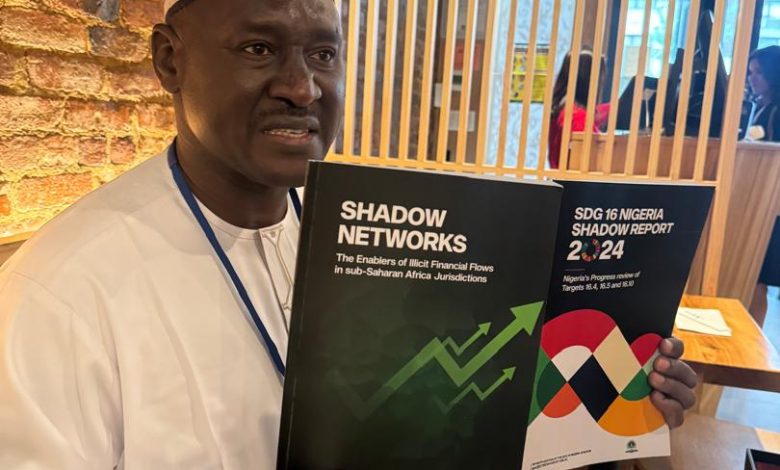

CISLAC, which told Nigerian government to curtail flamboyant lifestyle by its officials when the masses are suffering hardship in the country, spoke while presenting its annual report tagged the “7th Edition of the Sustainable Development Goal (SDG) 16 ‘Shadow’ Report for 2024”, which was submitted on the sidelines of the ongoing United Nations General Assembly (UNGA), in New York, United States of America, on Monday September 23, 2024.

The report, which highlights the key enablers of IFFs and presents comprehensive recommendations to combat the growing problem with copy sent to The DEFENDER, calls for a comprehensive approach to tackling both financial and non-financial enablers of illicit financial flows in Africa and Nigeria, in particular.

In his address, Executive Director Civil Society Legislative Advocacy Centre (CISLAC), Mallam Auwal Musa Rafsanjani, who is also the Head of Transparency International Nigeria, said, “It is a profound honor to stand before you today at the launch of the 7th edition of the Sustainable Development Goal (SDG) 16 ‘Shadow’ Report for 2024, a critical document that assesses Nigeria’s progress towards achieving key targets under SDG 16—promoting peace, justice, and strong institutions.

“This edition brings to light some of the most pressing challenges confronting our nation, particularly focusing on Targets 16.4, 16.5, and 16.10, which address organized crime, corruption, and public access to information, respectively.”

“Today, as we gather on the sidelines of the United Nations General Assembly, we are reminded that the global vision encapsulated in the Sustainable Development Goals is one that hinges on international cooperation and commitment.”

Rafsanjani, who also doubles as Chairman Board of Amnesty International Nigeria and Chairman, Transition Monitoring Group (TMG Nigeria), said, “For Nigeria, this report emphasizes that, despite noteworthy efforts, substantial challenges remain. In particular, achieving SDG 16 remains a daunting task — one that calls for introspection, reform, and bold actions.”

He called on African leaders to act swiftly and decisively, adding that, “The time for action is now. We must turn the insights from this report into strategies that rid Africa of the shadow networks siphoning off our continent’s wealth, and secure a brighter, more equitable future for all Africans.”

He emphasized the devastating impact of illicit financial flows (IFFs) on African economies, particularly in Nigeria, while noting that billions of dollars that should be allocated to critical sectors like education, healthcare and infrastructure are instead funneled out of the continent through clandestine networks.

According to him, “Africa’s abundant resources are being drained by shadow networks, leaving behind weakened economies and deepening inequality.”

The report, submitted by Auwal Musa Rafsanjani in the New York on Monday, underscores that the enablers of IFFs are not only found within financial institutions but also in non-financial sectors.

It said that the actors, that is, lawyers, real estate agents, customs officials and corporate service providers, provide a veil of legitimacy, allowing illegal funds to blend seamlessly into the legitimate economy.

In response, CISLAC has laid out eight key recommendations to curtail the influence of these networks and restore financial integrity across Africa.

These recommendations include: Enhancing political will, where its suggests that African leaders must show unwavering commitment to tackling IFFs by ensuring anti-corruption agencies operate independently and without political interference.

It recommended strengthening legal frameworks where governments are urged to introduce more robust anti-money laundering (AML) and counter-terrorism financing laws that cover both financial and non-financial enablers of IFFs.

Also, the report recommended promoting public sector integrity suggesting stronger asset declaration and transparency measures are necessary to hold public officials accountable, a key step in reducing corruption that enables illicit flows.

Others recommendations are Improving transparency and accountability asking for leveraging digital technologies such as e-procurement systems and advanced financial intelligence to reduce corruption, particularly in government contracts and procurement.

Similarly, it recommended regulating non-bank financial institutions where non-banking entities like real estate firms and art dealers must be held to the same regulatory standards as traditional financial institutions, conducting due diligence and reporting suspicious transactions.

Leveraging technology where it pointed out investment in technologies such as artificial intelligence, blockchain, and data analytics is essential to track illicit funds and enhance the effectiveness of Financial Intelligence Units.

It recommended fostering cross-border cooperation where it calls for stronger international cooperation to prevent any jurisdiction from becoming a safe haven for illicit financial flows.

The report also recommended supporting African-led research, report emphasizing the need for African-led research to understand the unique enablers of IFFs in Africa and develop tailored solutions.

Musa stressed the need for collaboration across governments, financial institutions, civil society, and the private sector to dismantle these networks.

“We must recognize the gravity of this challenge and commit to sustained action. Only through collaboration and relentless effort can we defeat the enablers of IFFs and secure a prosperous future for our continent,” he urged.

The CISLAC report, supported by the European Commission through the Rallying Efforts to Accelerate Progress – Africa Inequalities Initiative (REAP), offers a detailed look into how shadow networks operate in sub-Saharan Africa, with a focus on Nigeria as a case study.

It calls for a comprehensive approach to tackling both financial and non-financial enablers of illicit financial flows.

Rafsanjani called on African leaders to act swiftly and decisively, adding: “The time for action is now. We must turn the insights from this report into strategies that rid Africa of the shadow networks siphoning off our continent’s wealth, and secure a brighter, more equitable future for all Africans.”